Why we’re standing up to tax fraud

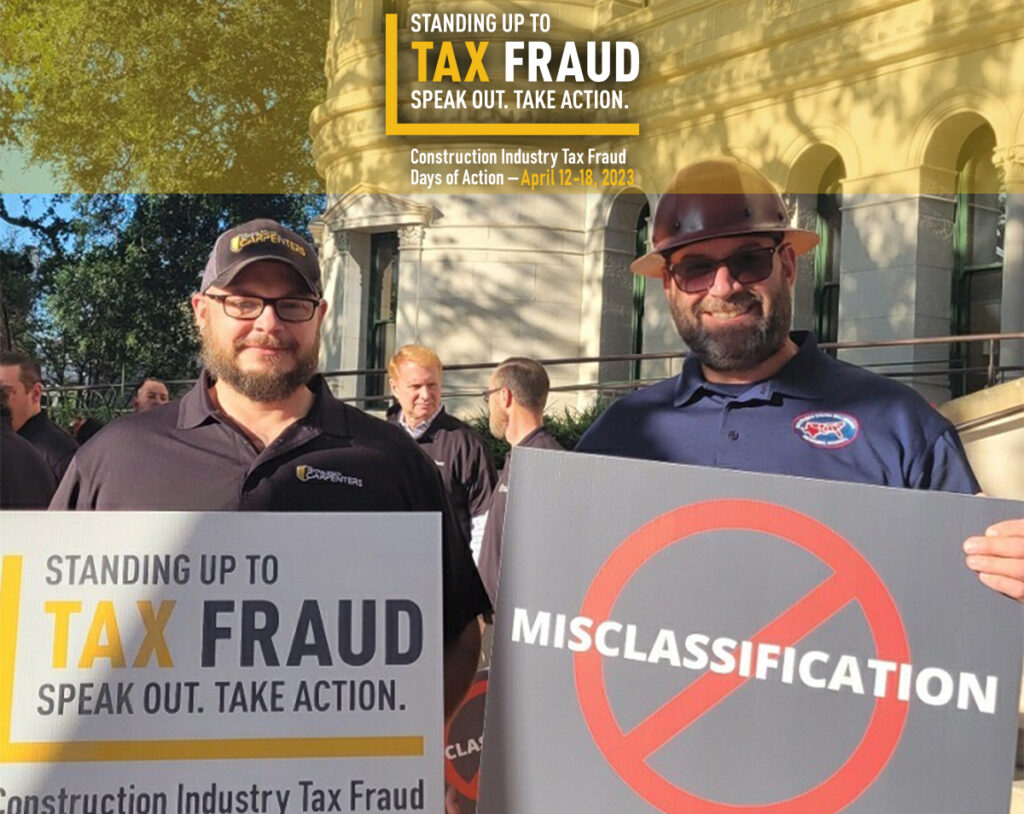

Tax fraud hurts everyone – workers, including our members, and their families, law-abiding contractors, communities, school children, veterans, and all taxpayers. That’s why we unite with the UBC and other regional during Tax Fraud Days of Action every year.

How tax fraud harms workers, including our members and their families

- Because contractors who misclassify workers or pay them off the books don’t pay workers’ compensation premiums or the employer portion of income taxes, they have lower labor costs and can underbid law-abiding contractors. That means less work for honest contractors – and their employees.

- Employees who are misclassified as independent contractors are responsible for paying an additional $76.50 in taxes for every $1,000 in taxable income each year.

- Workers for tax-fraud-committing contactors are more likely to be injured on the job, largely because these contractors do not invest in safety programs or equipment.

- Misclassified workers and those paid off the books are not covered by a workers’ compensation policy if they are injured on the job. As a result, they could be left holding a big medical bill.

- These workers are not eligible for employer-provided health, retirement, and other benefits, and they don’t receive benefits under the Family and Medical Leave Act.

- Contractors don’t report these workers’ wages to the Social Security Administration. This reduces or disqualifies them from Social Security benefits in retirement.

- If they are fired, misclassified or off-the-books workers do not receive unemployment benefits, and they can’t get help from government agencies to recover unpaid wages.

- Because employees working in the U.S. under visa programs often are ill-equipped to stand up to contractors who fail to pay the required fair wages and overtime, these practices are unfortunately common under such programs.

How law-abiding contractors, including our business partners, are harmed

- When contractors put together bids for construction and maintenance projects, labor costs are a major factor. Unscrupulous contractors who slash labor costs by misclassifying employees as independent contractors or by paying workers off the books often win contracts by placing low-ball bids while contractors who play by the rules have trouble competing.

- Law-abiding contractors pay workers’ compensation insurance premiums so their employees won’t be stuck with big medical bills if they get hurt at work. Contractors who cheat the system avoid paying these premiums.

- Honest contractors pay their employees on the books and correctly classify them as employees rather than independent contractors. This means they pay the employer portion of income taxes while many unscrupulous contractors do not, leaving their employees with higher tax bills.

- Ethical contractors run safer jobsites because they are more likely to invest in safety training and equipment than their unethical competitors.

- Law-abiding contractors pay for health, retirement, and other benefits for their employees while contractors who misclassify employees and pay them under the table do not.

How communities are harmed

- Loss of public revenue at the local, state, and federal levels makes it difficult to:

- Repair and maintain roads, bridges, and other local infrastructure;

- Fund public education;

- Care for veterans; and

- Provide other essential services.

- When average income levels are low across a community because employers, including construction contractors, are not paying fair wages, businesses throughout the community can suffer and close.

- The same thing can happen to hospitals and other health-care facilities, especially in rural areas.

- The two previous items can stunt community growth and perpetuate low area wages. If essential services and businesses aren’t present in a community, new businesses that could introduce competitive wages will be hesitant to locate there.

How taxpayers are harmed

- A study released in January by the University of California Berkeley Labor Center reveals that 39 percent of construction-worker families in the United States are forced to enroll in one or more safety-net programs, including food assistance and Medicaid, to make ends meet. Researchers found low pay, wage theft, and illegal employment practices typically made workers eligible for the safety-net programs. Paying for these families’ benefits through those programs costs taxpayers $28 billion annually. See the study.

- Another study shows that taxpayers must make up for $8.4 billion each year in tax revenue that’s lost when law-breaking contractors pay workers off the books or misclassifying them as independent contractors. See the study.

How the SSMRC is fighting construction-industry tax fraud

Throughout the year, the Southern States Millwright Regional Council works to raise construction-tax-fraud awareness among elected officials, to strengthen employment laws, and to beef up enforcement of existing laws.

The SSMRC’s 2023 TFDoA campaign targets state legislators and their staffs with geofence ads at all 11 state capitols in our jurisdiction. We’re letting legislators and staffers know about the $8.4 billion problem of construction-industry tax fraud and how it harms everyone. We’re also demanding action. Check out the campaign landing pages here and here.

SSMRC leaders also are meeting with bankers to educate them on the red flags of construction-industry tax fraud. In addition, we’re running social-media posts to better inform our members about the problem of construction-industry tax fraud and how it affects them and their families.